Only Private Equity funds whose manager’s or management team’s previous funds have in the past performed within the Top Quartile of returns as measured by the relevant benchmark, will be considered for investment by VPEG4.

This selection criterion enhances the likelihood of VPEG4′s Investment Portfolio itself achieving Top Quartile returns. A comprehensive and rigorous system for the screening of fund managers for investment has been developed by the Investment Manager, a summary of which is outlined below.

The Investment Manager makes recommendations to the investment committee of the Fund to make Commitments and invest in unlisted Private Equity funds whose managers and funds typically meet the following criteria.

Manager Selection Criteria

- focus on investing within a specific region within Australia;

- strong local market knowledge and presence;

- focus on small to mid-market later expansion or buyout sectors;

- comprehensive strategy and criteria for industry sectors and investment type.

- active management style of underlying investments;

- transparent monthly, quarterly and annual reporting to investors;

- fund independently audited on an annual basis;

- tax effective fund structure.

- core fund, executive team, have worked in current or previous private equity fund for a minimum of 5 years

- more than 50% of investment from previous fund, in existence for at least 5 years, have been exited or realised

- track record of delivering strong returns from chosen investment strategy

- top quartile investment performance from previous fund

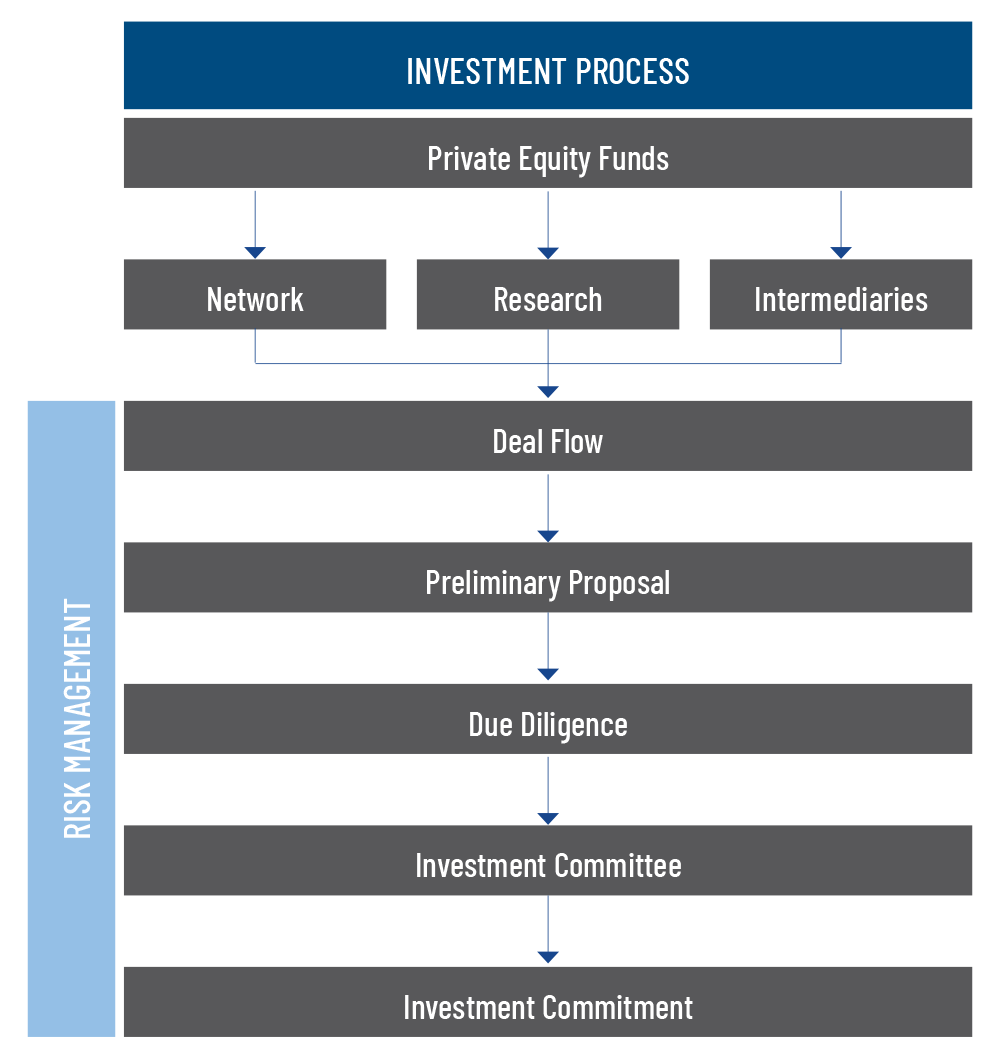

The underlying fund selection and investment process that the Investment Manager systematically adheres to for its management of VPEG4′s Private Equity portfolio is illustrated in the following figure:

Out of the universe of Australian Private Equity funds, the Investment Manager expects to evaluate a considerable number of investment opportunities that ultimately should result in Commitments and investments in up to eight Private Equity funds (both Primary & Secondary) within 24 months of the Final Closing Date of VPEG4.

When fully invested VPEG4 will have ultimately held a share in up to 50 underlying private equity company investments, providing a well-diversified portfolio of profitable, private company investments, across a range of industry sectors.