RECENTLY COMPLETED & ANNOUNCED EXITS DELIVER VANTAGE FUNDS AN AVERAGE GROSS 4.3 X RETURN ON INVESTED CAPITAL

VPEG4 COMPLETES FINAL CLOSE WITH $180M OF COMMITMENTS FROM OVER 500 INVESTORS

VPEG5 COMPLETES FIRST CLOSE WITH $37 MILLION OF COMMITMENTS FROM OVER 200 INVESTORS & REMAINS OPEN FOR INVESTMENT

VANTAGE FUNDS COMMIT A FURTHER $150 MILLION TO UNDERLYING PRIVATE EQUITY FUNDS & CO-INVESTMENTS

VANTAGE FUNDS CONTINUE TO DELIVER STRONG RETURNS

With the exit environment continuing to be supportive across the last quarter of 2021 and into early 2022, a number of underlying company investments within Vantage’s Private Equity Growth Fund portfolios were recently sold, either by secondary sale to a larger institutional investor or trade sale to a strategic acquirer. Across the period from October 2021 to March 2022, eight portfolio companies were sold (exited) from the portfolios of VPEG (1 sold) and VPEG2 (7 sold). Once completed, these exits will deliver an average gross 4.3 X return on invested capital, representing an average gross Internal Rate of Return (IRR) of 209% per annum.

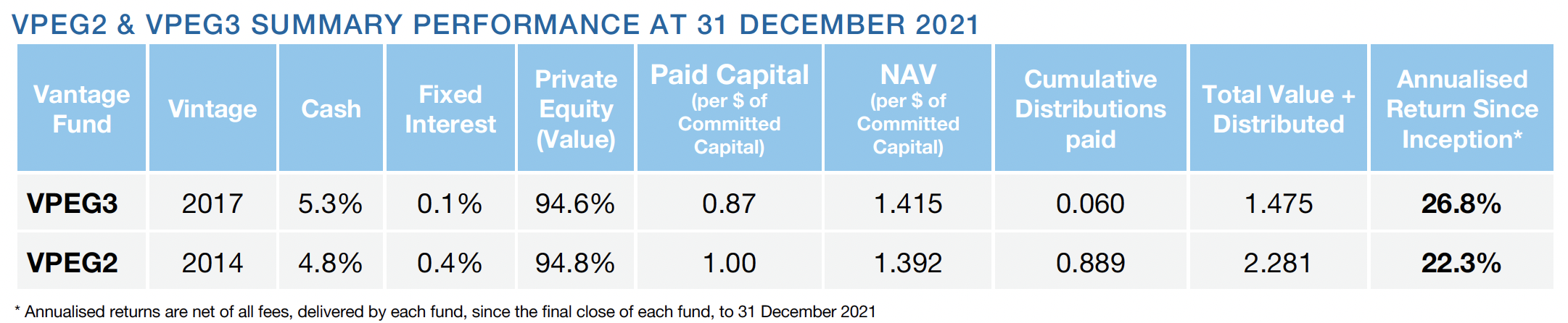

As a result of these exits and the growth in value across the remaining portfolio of investments in VPEG2 and VPEG3 each Fund’s total return to investors continues to improve. As a result, VPEG2 and VPEG3 have now delivered a net of fees return to investors of 22.3% p.a. and 26.8% p.a. respectively from each Fund’s final close (May 2015 and January 2019) through to 31 December 2021.

Vantage expects the performance of these funds to continue to improve as the remaining companies within each portfolio mature, achieve their growth targets and are ultimately sold, resulting in further, consistent distributions and enhanced returns to investors.

VPEG4 Completes Final Close with $180 million of Investor Commitments

On 30 September 2021, Vantage Private Equity Growth 4 (VPEG4) completed its final close with more than 500 investors committing approximately $180 million to the Fund. Many existing Vantage Fund investors participated in VPEG4 and Vantage also welcomed many new investors from across the world who learnt about Vantage’s unique and focussed Private Equity Fund of Funds strategy and previous performance for the first time prior to investing.

With final close completed, Vantage is now set to complete VPEG4’s investment commitments to at least a further two underlying Private Equity funds by the middle of 2022, to ensure all capital committed by investors is deployed into Private Equity managed company investments which will ultimately build a highly diversified portfolio of approximately 50 underlying company investments.

For more information about VPEG4 please visit https://vpeg4.info/

New Private Equity Commitments & Co-investments

Across the past six months, the Vantage team have spent a considerable amount of time conducting extensive due diligence on several private equity funds and co-investment opportunities within the Australian and New Zealand lower to mid market.

The completion of this due diligence process led to the recommendation by Vantage and the approval by the Investment Committee of each of VPEG4 & VPEG5 for a cumulative total of $140 million in new or additional investment commitments to the following funds; the Advent Partners 3 Fund, Allegro Fund IV, Anchorage Capital Partners Fund IV, and CPE Capital 9.

In addition, the Investment Committee’s of Vantage Managed Funds recently approved and / or completed a total of $10 million in commitments and investments across three co-investment opportunities managed by each of Advent Partners, Allegro Funds and The Riverside Company.

As a result of the recent public market volatility, the ongoing disruption to business models and the requirement for businesses to adapt to the current economic environment, Vantage’s underlying managers are reporting an increased momentum in deal flow and have recently entered exclusivity with a number of high-quality investment opportunities across a range of industry sectors. Some of these companies, no doubt, are seeking transformation expertise, creating ideal intervening opportunities for Vantage’s underlying managers to add value and drive growth in each company investment as they are made.

VPEG5 Completes First Close and Remains Open for Investment

During December 2021, Vantage Private Equity Growth 5 (VPEG5) completed its first close with more than 200 investors committing approximately $37 million to the Fund, enabling VPEG5 to commence its investment program. VPEG5 also remains open for investment for new investors and will conduct monthly closes until its target fund size of $250 million is reached.

VPEG5 continues the same successful investment strategy implemented by Vantage’s previous funds, which at 31 December 2021 had investments across 27 Australian Private Equity Funds, who in turn had invested in 149 companies across a broad range of industry sectors and had exited (sold) 70 of these investments generating a gross 3.1x multiple of invested capital delivering an average gross Internal Rate of Return of 41.8% p.a.

If you wish to learn more about VPEG5 as a potential investment opportunity, please contact your financial advisor or alternatively email [email protected] to request a meeting with a Vantage executive for more information.

Alternatively to invest in VPEG5, please click the invest now link below;